Other Deductions - Charitable Donations

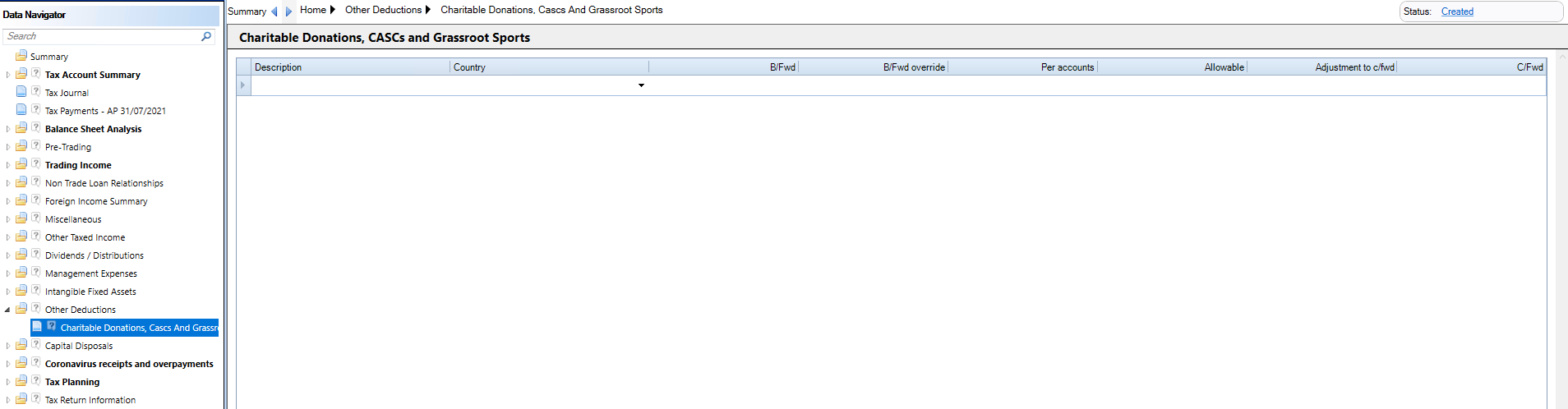

The Charitable Donations input is located under Other Deductions > Charitable Donations in the Data Navigator.

Enter the Description.

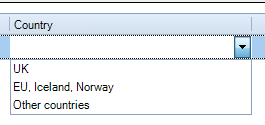

Select the Country from the drop down list;

The Bfwd amount should be the value of the Cfwd amount from the previous Period of account. If this value needs to be amended then enter this value in the Bfwd override column.

Enter the Per accounts amount or link from the Profit and Loss.

Enter the amount Allowable as a deduction in the period.

Adjustment to Cfwd is to adjust the value to be shown in the Cfwd column.

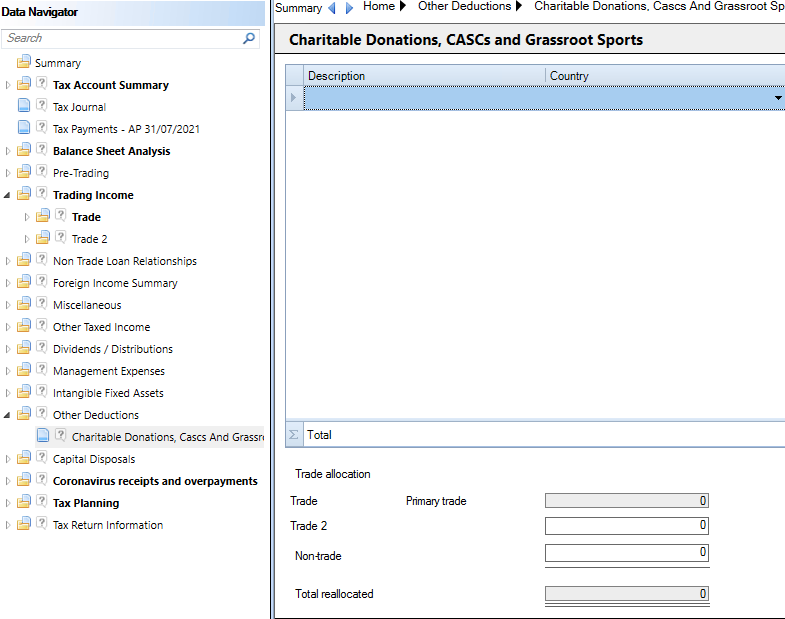

You can allocate via the Trade Allocation grid if there is either more than one business/trade.

To calculate whether you have excess charitable donations which can be surrendered as Group Relief you need to recalculate the adjusted income for the period to exclude any losses brought forward AND capital allowances for the current period.