Disallowables / Adjustments

Alternatively the statement can be linked from the Profit and Loss.

Entering adjustments/Allowables

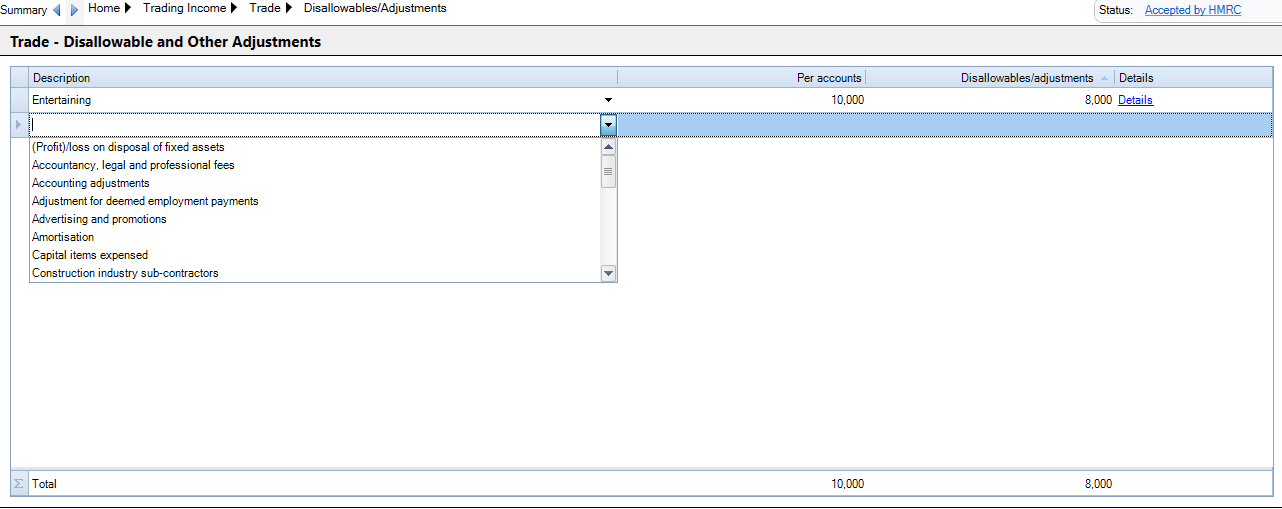

Disallowables adjustments is located under Trading Income > (Trade name) Adjustments/Disallowables in the Data Navigator.

Select the Description from the drop down menu or enter it manually.

The entries made via the Drop down menu are Tagged in the computation. Manual entries are not Tagged.

Enter the Per accounts amount or link from the Profit and Loss.

Enter the Disallowables/adjustments amount. An addition to the profit should be made as a positive amount and an amount to be deducted from the profit should be entered as a negative amount.

Once a menu choice has been made from the drop down menu this option is not available to be chosen again. If more than one entry is required then provide an analysis via a Details analysis.

If an Analysis of the entry is required then click on the Details link which appears in the Details column.

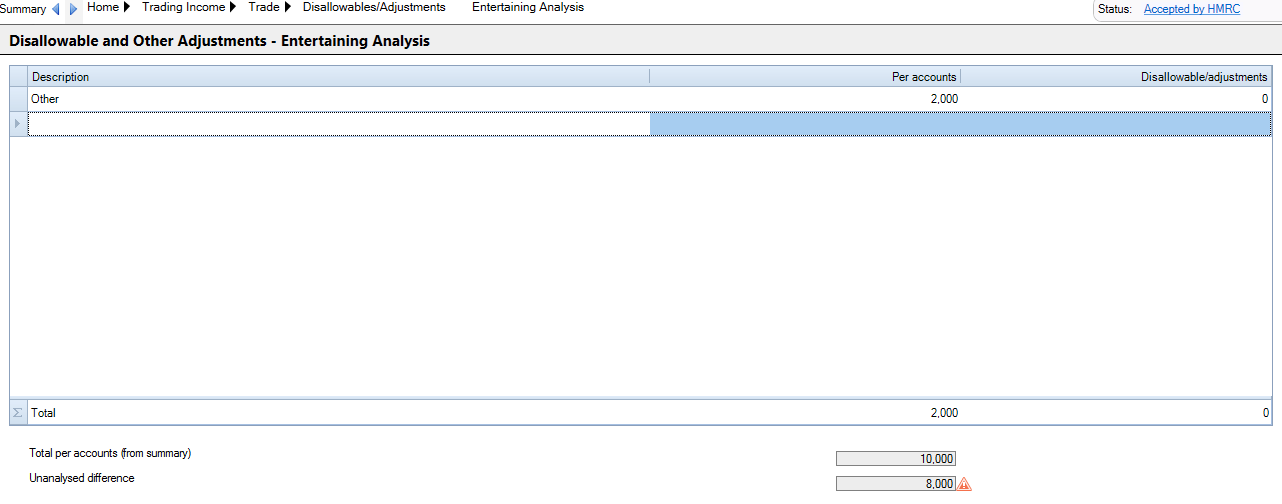

Entering details in analysis window

If an Analysis of the entry is required then click on the Details link. An analysis window will open.

Enter the Description, Per accounts and Disallowables/adjustments amounts.

The aggregate of the Per accounts column will reconcile to Total per accounts (from summary). If the amounts are not the same then an entry will be shown in the Unanalysed difference box.

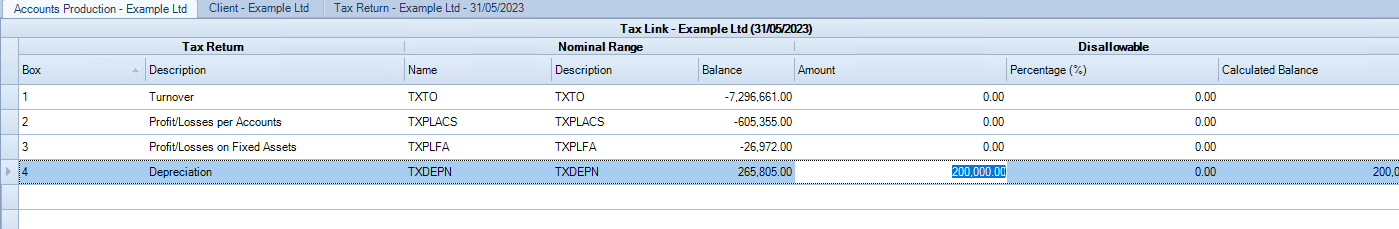

Users can adjust for allowable amortisation included in the depreciation add back by

- Either enter the amortisation as a negative disallowance to set against the total Depreciation entry. You can also amend the Amortisation heading to include "allowable" if you so wish or add a note to provide further information.

- In Tax Links in CCH Accounts Production make an adjustment in the Disallowable "Amount" column on the Depreciation line. The depreciation add back in CT will then be restricted to whatever is manually entered in that box.

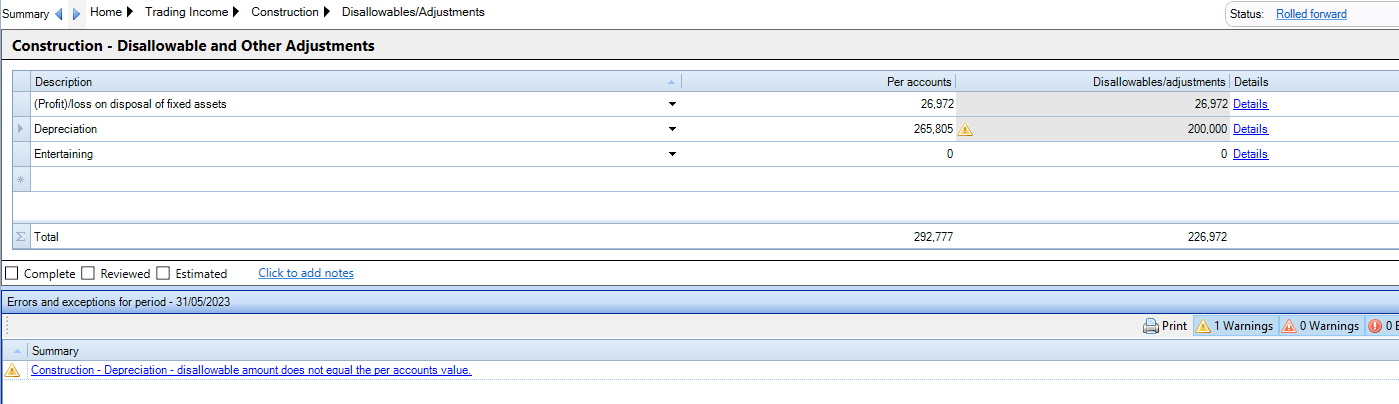

When the Corporation Tax period is updated from accounts, a warnign will appear in the Errors and Exceptions for the period panel;

This warning will not prevent online submission.

This warning will not prevent online submission.