Overview: Connecting CCH Accounts Production

CCH Open Integration is accessed as part of CCH OneClick. It allows data to be brought from a client's bookkeeping system into CCH Accounts Production to be worked on. Transactions can then be added in CCH Accounts Production and uploaded back to the bookkeeping system.

What is Open Integration?

Open Integration enables the efficient transfer of financial data to and from our Central suite. It includes the ability to synchronise data from CCH Accounts Production into Open Integration at a transactional level for the transferring of financial data to support with quarterly submissions to HMRC for the purpose of Making Tax Digital. When a business has been connected to CCH Accounts Production the transactions will automatically be pulled

into Open Integration every evening. We have also provided you with the ability to sync transactions on demand thereby giving you the option to view up to date data.

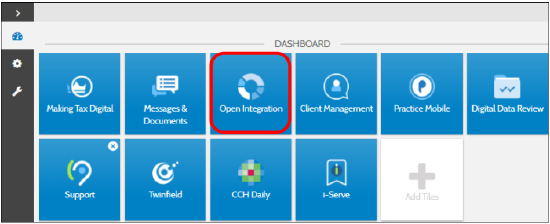

Accessing Open Integration

Open Integration is an integral part of CCH OneClick. In order to access Open Integration you must have an activated OneClick account, please speak to your administrator for you CCH OneClick credentials. On the OneClick Dashboard click on the Tile 'Open Integration'

Setup and Configuration

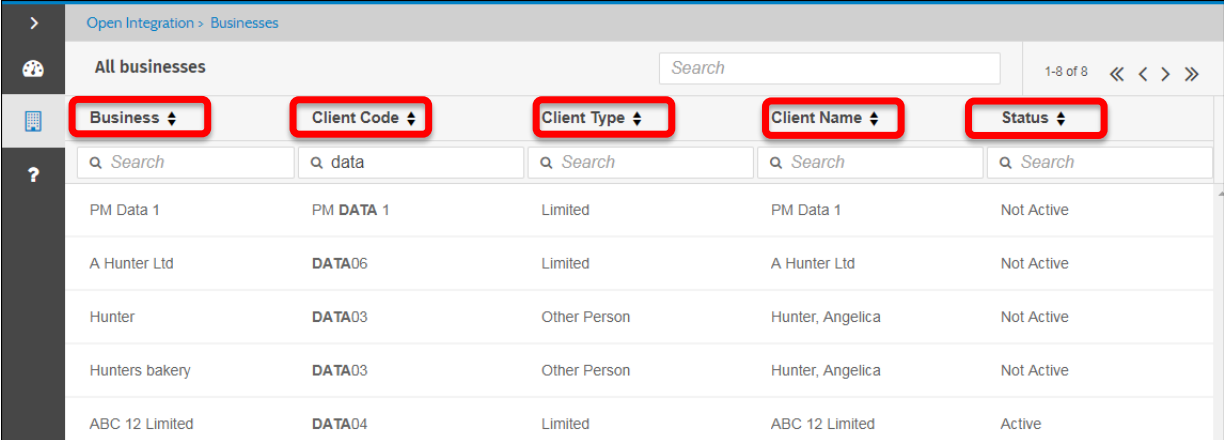

Click the businesses tab icon from the left hand panel. Then select the relevant business

Tip: you can search for the Business by Business name, Client code or Client name

Note: If the Status is 'Not Active' this means the Business has not been configured to a data source.

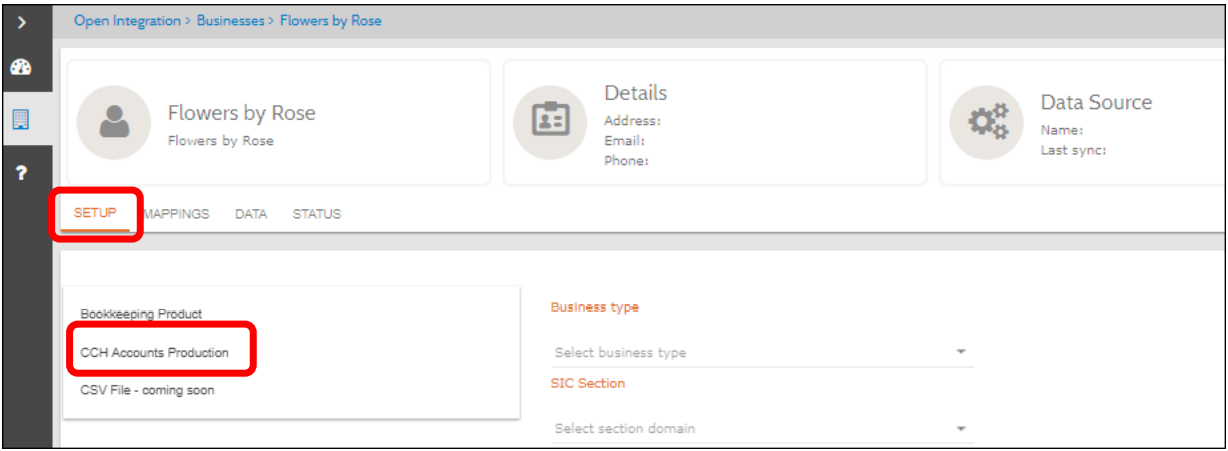

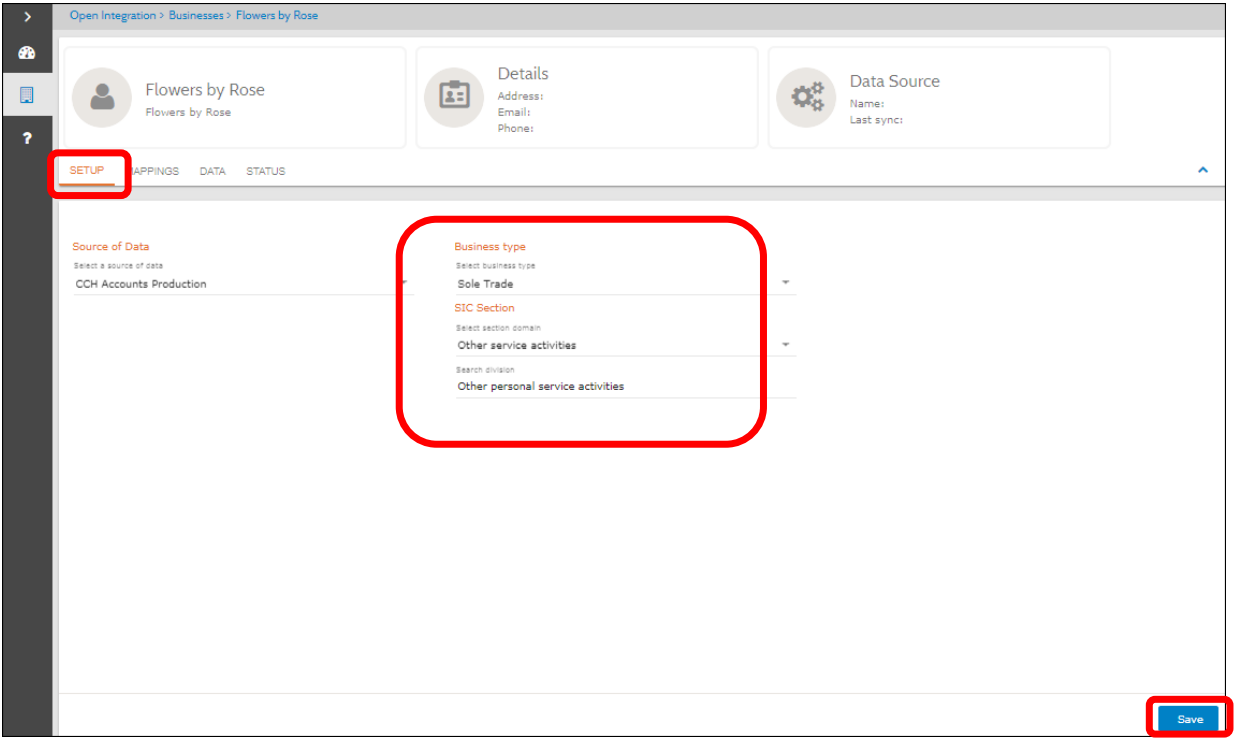

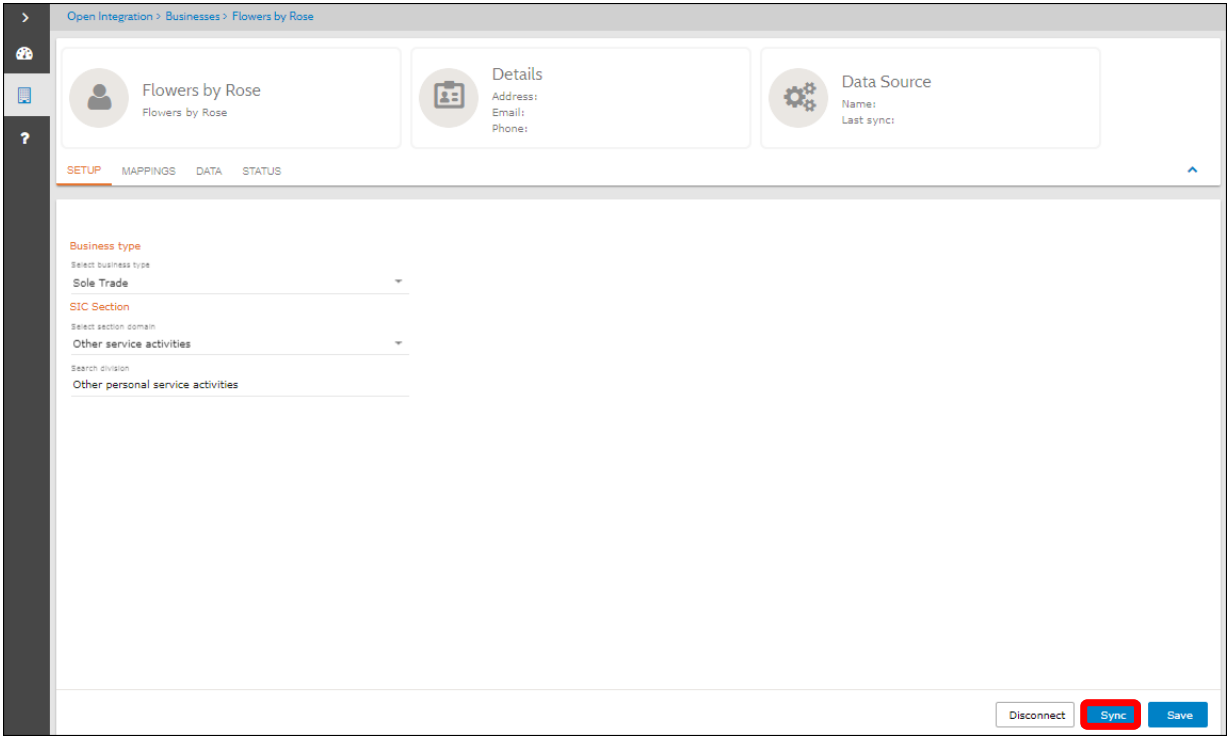

Connecting a business to CCH Accounts Production

- Click on CCH Accounts Production below source of data

- Select the relevant Business type and SIC Section

- Click on Save

- Click off the setup tab, then click back onto the setup tab

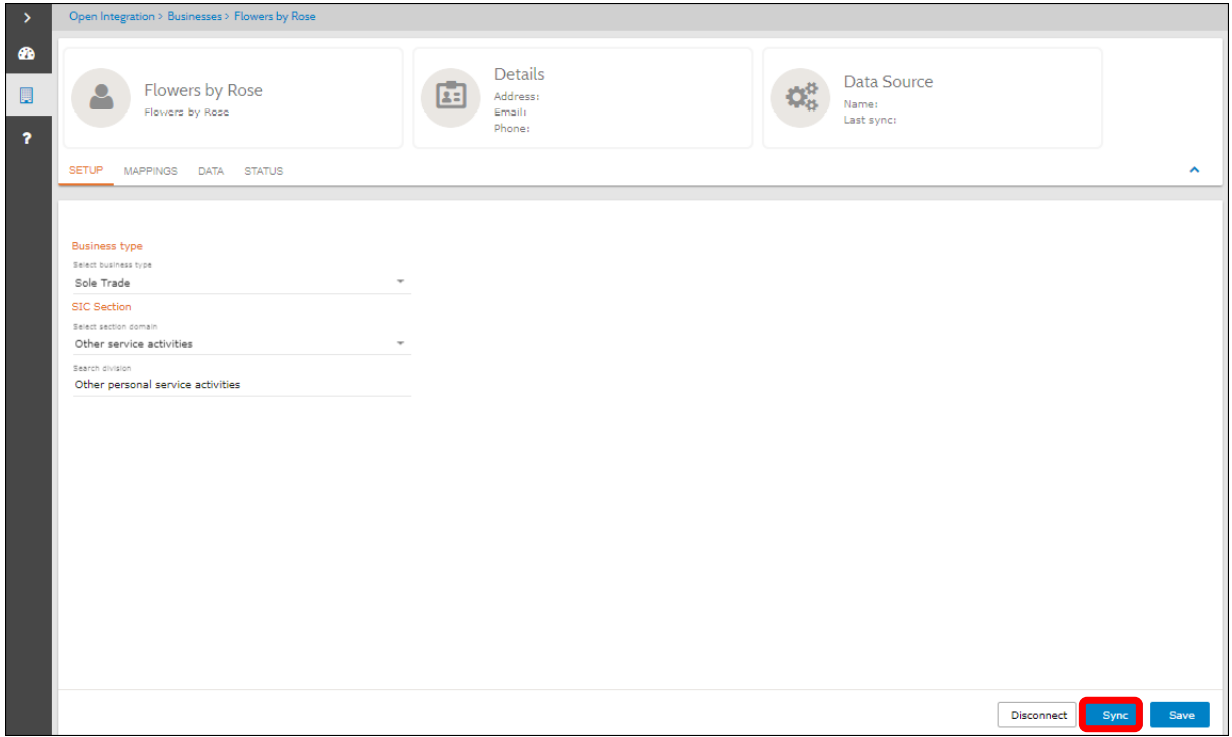

- Click on the Sync button

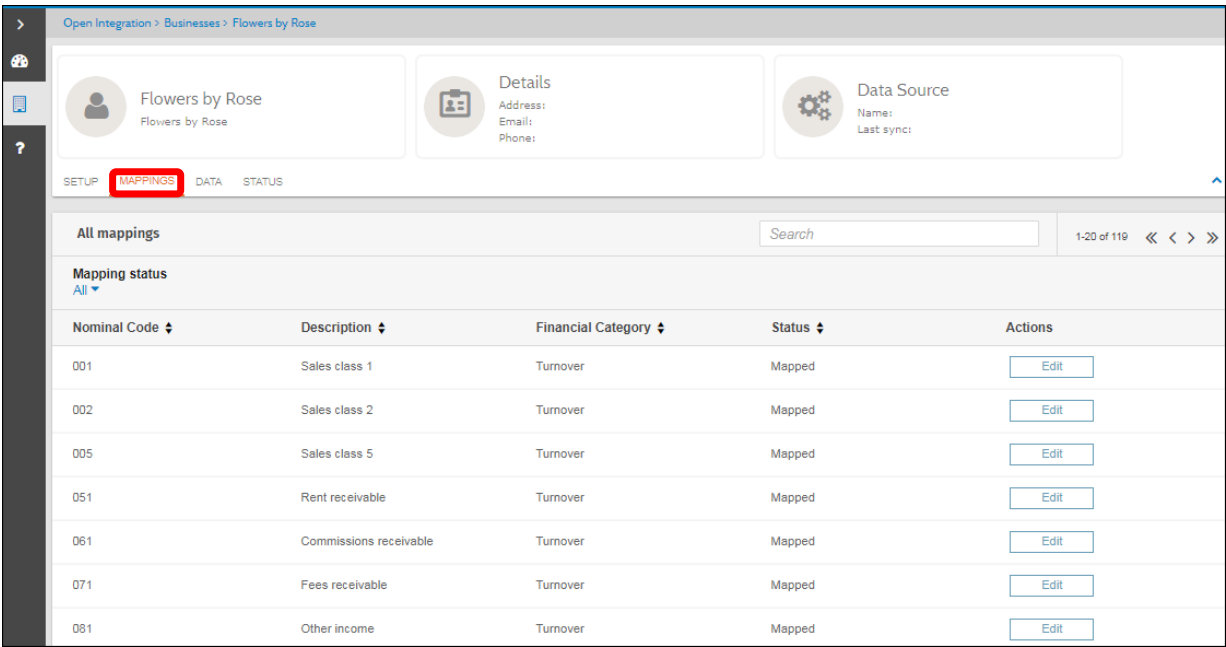

Mappings

These mappings display the financial reporting category that each nominal code form CCH Accounts Production Data will be mapped into for HMRC quarterly reporting.

Note: If other Business types are selected other than Sole Trade then the mappings tab will display the following message ‘There are no mappings to display’. The mappings tab is only applicable for HMRC MTD quarterly reporting.

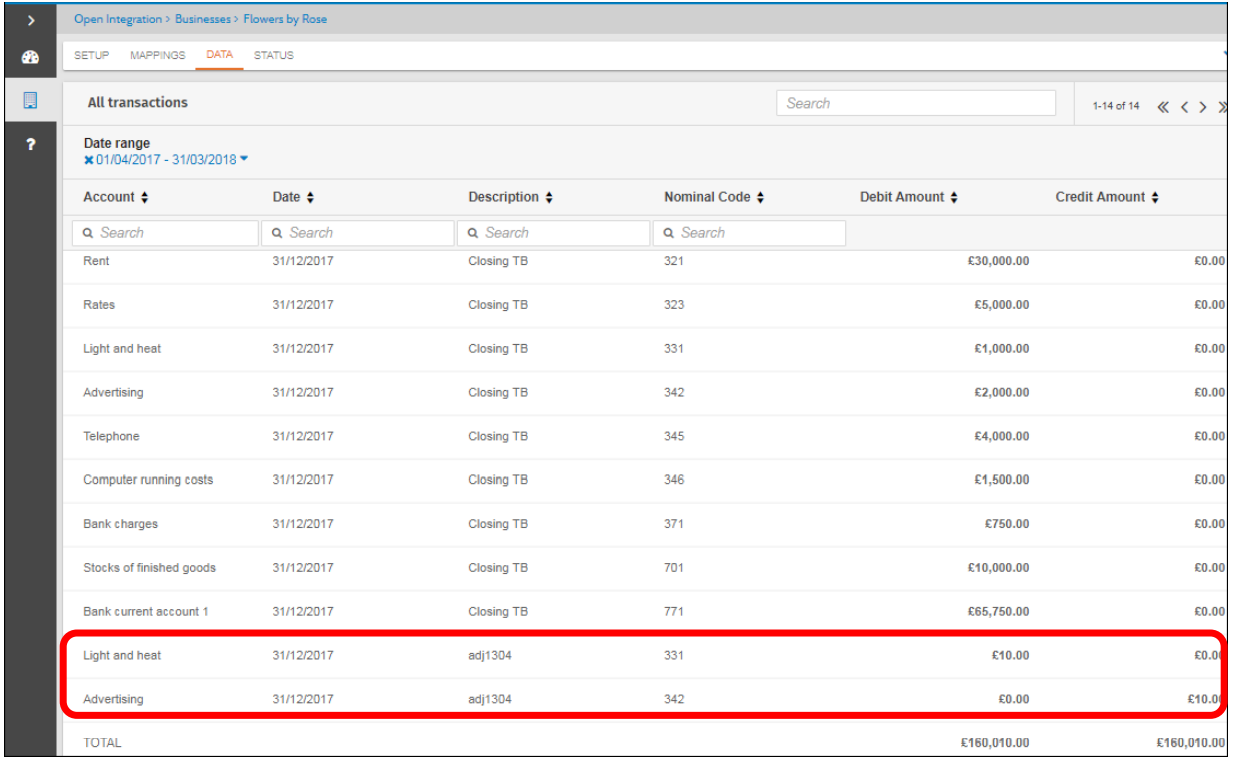

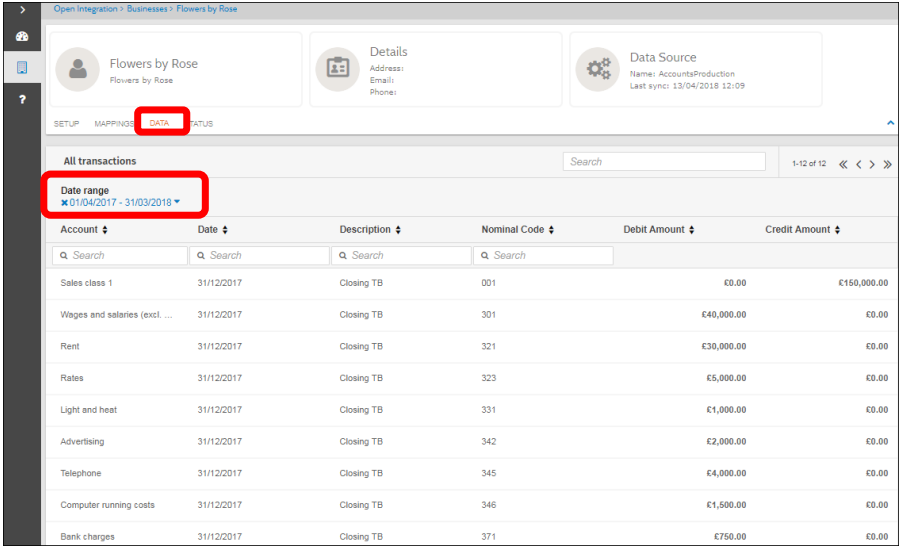

Data Tab

- Change the data range to view transactions for a given period

- Once connected to CCH Accounts production, the data will be synchronised automatically. The data is then updated each evening displaying all daily transactions within the specified date range

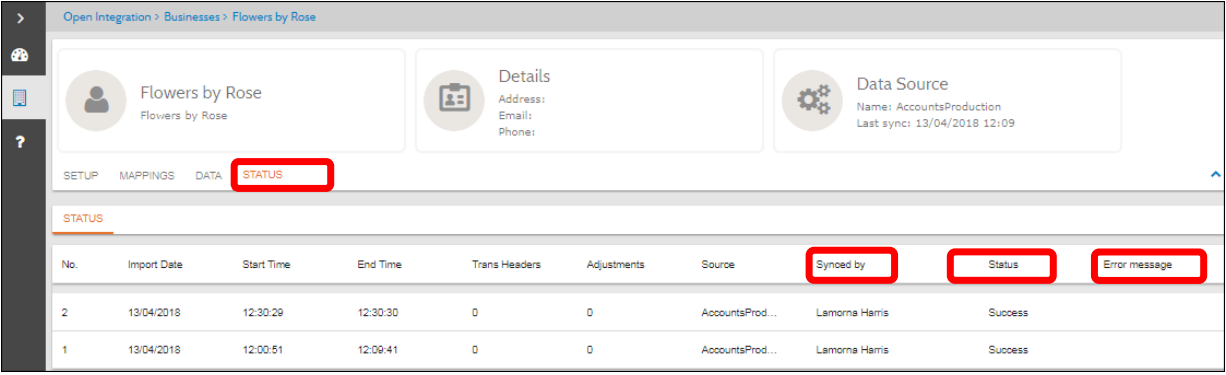

Checking the Status

View the status of imported data, successes and failures. View data which has been synced on demand and by whom.

Sync on Demand

Note: If further adjustments are made with CCH Accounts Production and you do not wish to wait until the automatic pull of data, you can Sync no demand. To sync on Demand click on the Sync button

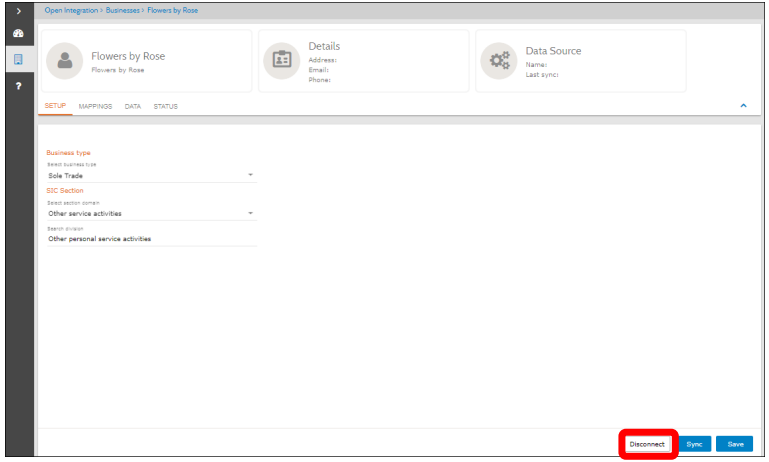

Disconnecting a Business from CCH Accounts Production

- To disconnect a Business from CCH Accounts Production click on the Disconnect button.

- If transactions have been edited within CCH Accounts Production, they will be displayed in Open Integration as separate transactions.