Periods

Periods

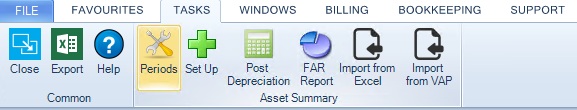

Periods are accessed via the Periods icon on the Fixed Asset Register (FAR) Asset Summary ribbon:

Adding new Accounting Periods

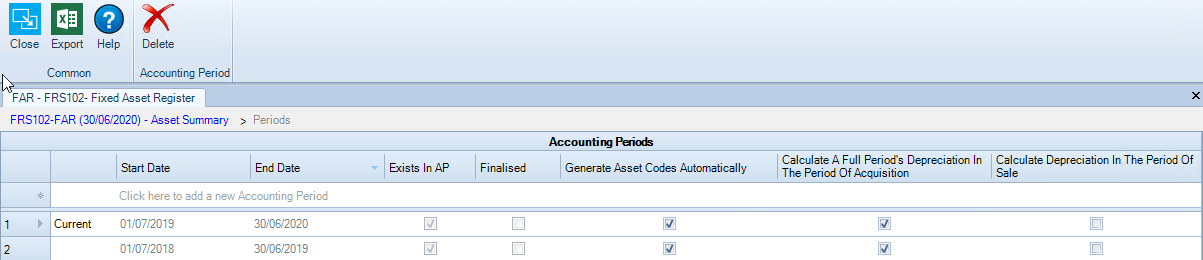

From here new accounting periods may be added and options selected as below:

Types of Accounting Period

- Accounting Periods that are linked to CCH Accounts Production

All accounting periods in CCH Accounts Production (CCH AP) are automatically included on the Periods screen. The dates of these periods cannot be amended in the FAR

- Accounting Periods that are not linked to CCH Accounts Production

Additional accounting periods can be set up that exist only in the FAR and are not linked to CCH Accounts Production. This is useful if the history of the fixed assets needs to go back further than the accounting periods in CCH Accounts Production

These periods can also be created automatically if a CCH Accounts Production accounting period is deleted; this leaves behind a FAR Accounting Period that is not linked to CCH Accounts Production

Explanation of the Asset Summary ribbon

Start Date and End Date

If the accounting period is linked to CCH Accounts Production then it cannot be edited. The system ensures that there are no gaps between periods

Exists in AP

Indicates that the accounting period is linked to CCH Accounts Production and cannot be edited

Finalised

If the accounting period is linked to CCH Accounts Production then this is the same as the Finalised indicator. If not, then this can be ticked to finalise a period. No further changes can be made in the FAR to a finalised accounting period without unticking this check box

Generate Asset Codes Automatically?

If this box is ticked the system generates the code for new assets automatically. If the asset belongs to Asset Class MV (for Motor Vehicles) then the first asset is given the code MV00001, the second MV00002 and so on

Calculate a Full Period's Depreciation in the Period of Acquisition?

If this box is ticked for an asset purchased during an accounting period a full year's depreciation is calculated , instead of calculating from the date of acquisition. This is a common accounting treatment.

Calculate Depreciation in the Period of Sale?

If this setting is ticked then depreciation is calculated from the period start date to the date of sale. If this setting is unticked then no depreciation is calculated in the year of sale. This is a common accounting treatment.

Note: If you perform a Year End in CCH Accounts Production and then go into the Fixed Asset Register, a new accounting period is created automatically in the Fixed Asset Register mirroring the period in CCH Accounts Production. The settings for the new period are copied from the previous period

It is possible to change these settings at the year end if there is a change of accounting treatment

Purchase / disposal of an asset

If an asset is bought and sold in a single year, then the Period of Acquisition and of Sale are the same period. If Calculate Depreciation in the Period of Sale? is unticked, the system does not calculate depreciation, even if Calculate a Full Period's Depreciation in the Period of Acquisition? is ticked.

If you do not wish depreciation to be calculated in the period of acquisition if the asset is bought just before the period end date, set the asset’s Depreciation Start Date to the first day of the next period.