Allocating Additions and Disposals in CCH Personal Tax to an Asset/Pool type

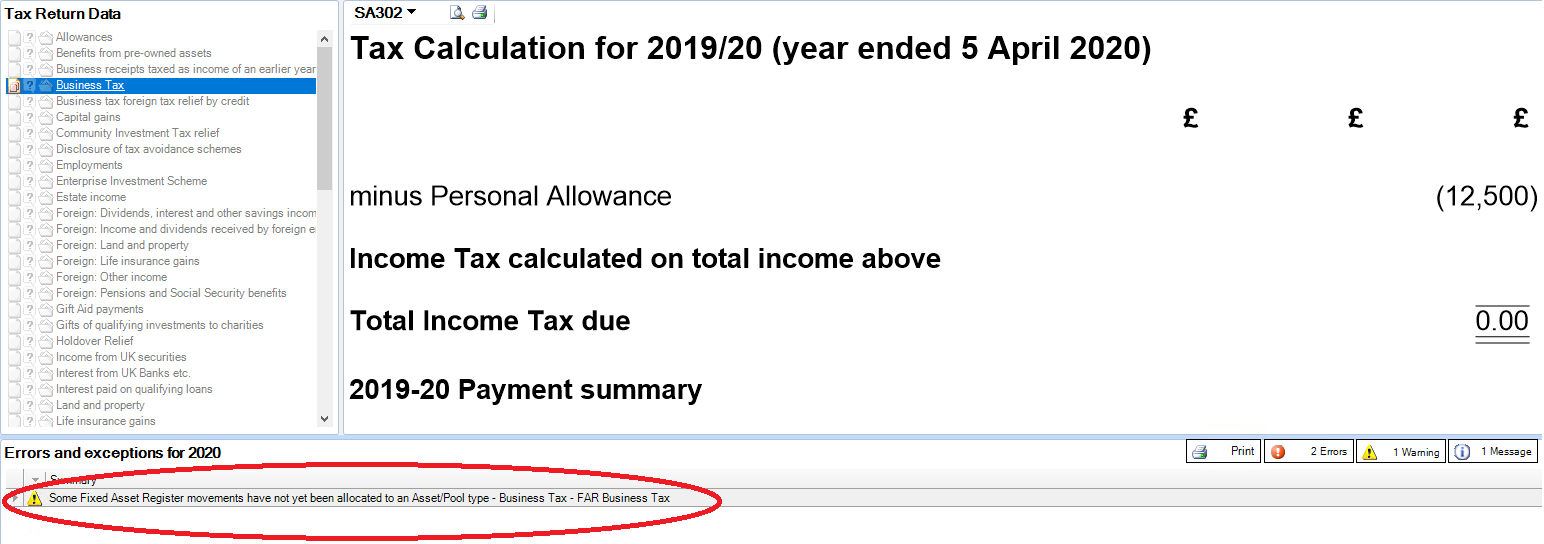

Once updated from accounts, if there are any new movements that have not been imported previously, a Warning appears in the Errors and Exceptions panel;

Some Fixed Asset Register movements have not yet been allocated to an Asset/Pool type.

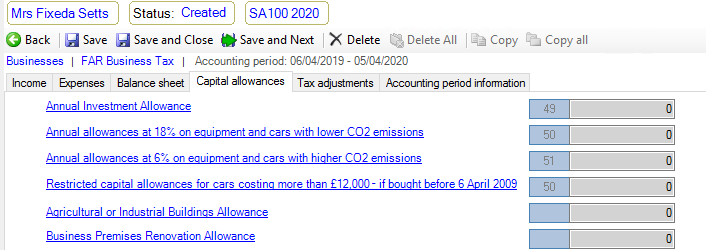

If there are unallocated movements, click on the message to go into Business Tax and select the business and Accounting Period

Click on the Capital Allowances tab and click any of the links to allowances, e.g. Annual Investment Allowance

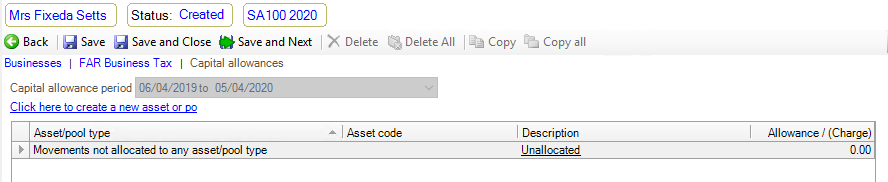

A list of Asset/pool types is displayed.

Next to Asset/pool type entitled Movements not allocated to any asset/pool type click on the Unallocated hyperlink in the Description column.

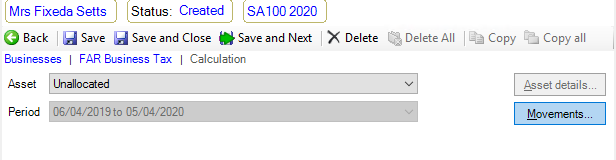

Select Movements to analyse any movements in asset balances for tax purposes.