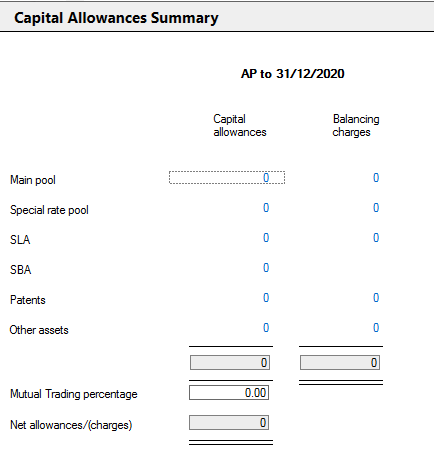

Capital Allowances Summary

Viewing the Capital Allowances Summary Window

This is located under Trading income > Trade name > Capital Allowances or Management Expenses > Capital allowances.

You can access the data screens for each allowance by a click on the hyperlinked value.

Capital Allowances include Balancing Allowances.

Mutual trading entities

A reduced claim to allowances and charges for Mutual trading entities should be made in the window.

Enter the percentage of the overall allowances and charges to be claimed in the Mutual Trading percentage box

The Net allowances/(charges) being claimed as a result of the percentage entered is displayed

The CT600 will automatically show the restricted amount of allowances and charges claimed.

The computation will only show the percentage claimed on the Capital allowances Summary reports for both trades and Management Expenses.