Pensions

This is located at Trading Income, Trade Name, Pensions

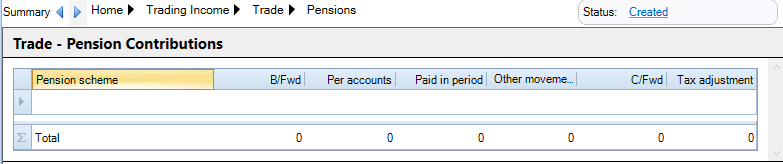

Enter a description in the Pension scheme column.

In the first POA in CCH Corporation Tax enter the amount B/fwd. The B/fwd amount in later POAs will be taken from the entry in the C/fwd field from the prior POA.

Enter details of the amount included in the accounts in Per accounts

Enter details of the amount paid in the POA in Paid in period

Enter details of any adjustment to the C/fwd value in the Other movement. Any value entered here will not affect the automatically calculated value of the Tax adjustment for the POA.

The amount C/fwd is automatically calculated. This value will be shown in the next POA as the B/fwd value. It is calculated as B/fwd amount plus Per accounts amount less the amount in the Paid in period and less the amount in Other movement.

The Tax adjustment is automatically calculated. It is calculated as the Per accounts value less the amount Paid in period.

The Tax adjustment is included within the Balance sheet adjustment figure in the Trade Summary window.